SFS Insights: Volatility Is The Toll We Pay To Invest

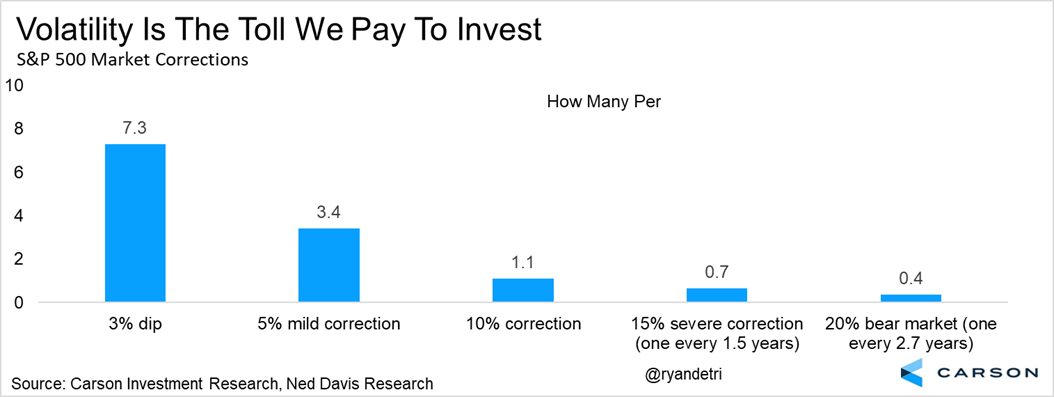

Volatility is the toll that we pay for enjoying longer-term returns. Here’s what you need to know regarding the S&P 500:

- Each year sees more than seven different 3% percent dips.

- More than three times a year, stocks correct 5%.

- About once a year on average sees a 10% correction.

- A 15% major correction happens every year-and-a-half.

- A 20% bear markets happens about every three years.

The longer-term returns of the S&P 500 as of 12/31/23 are:

3yr average: 10%

5yr average: 15.7%

10yr average: 12%

15yr average: 14%

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.