SFS Insights: US Housing Outlook

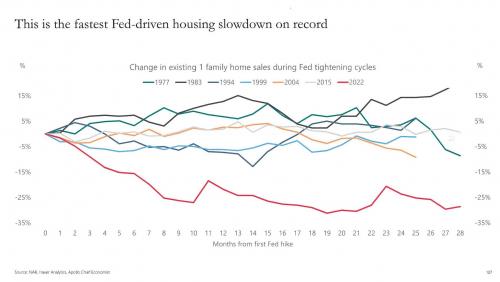

Today, we are experiencing a gradual slowdown engineered by the Fed. The Fed raised interest rates to slow down the economy to slow down inflation.

The housing recovery continues to be driven by low supply. But housing demand is gradually softening because of high mortgage rates, high home prices, and rising unemployment.

Inflation has now come down, and the Fed can begin to focus on other parts of the economy, particularly the labor market but also the housing market. If the Fed doesn’t like what they see, they will lower interest rates faster.

The bottom line is that the ongoing soft landing in the economy also implies a soft landing in the housing market.