SFS Insights: Support For A Soft Landing

- A good start to holiday shopping season supports the soft-landing narrative. Online sales since Black Friday are up 5% over the same period last year according to Adobe. Lower prices at the pump, falling goods prices, higher stock values, and rising wages should help keep the momentum going.

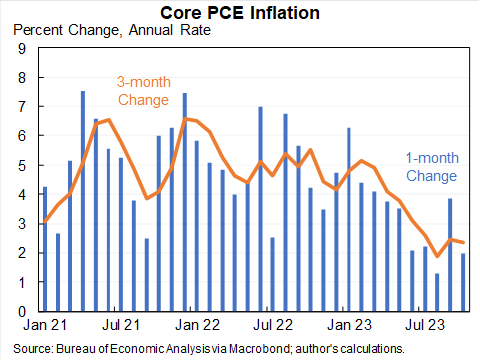

- The other key piece of the soft-landing equation, inflation, is well on its way to the Federal Reserve’s 2% target. Remarkably, the preferred inflation measure, the core personal consumption expenditures (PCE) deflator, rose at just a 2.2% annualized pace over the past three months, down from 5.3% in the year prior.

- Looking ahead, the combination of corporate America’s solid fundamental foundation and the support from lower interest rates could set the stage for more stock gains in the coming year. The slowing economy will help ease inflation. Less inflation will help promote interest-rate stability. And earnings are entering their sweet spot following an excellent third quarter earnings season.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.