SFS Insights: Strong Tailwind to Stocks and Bonds

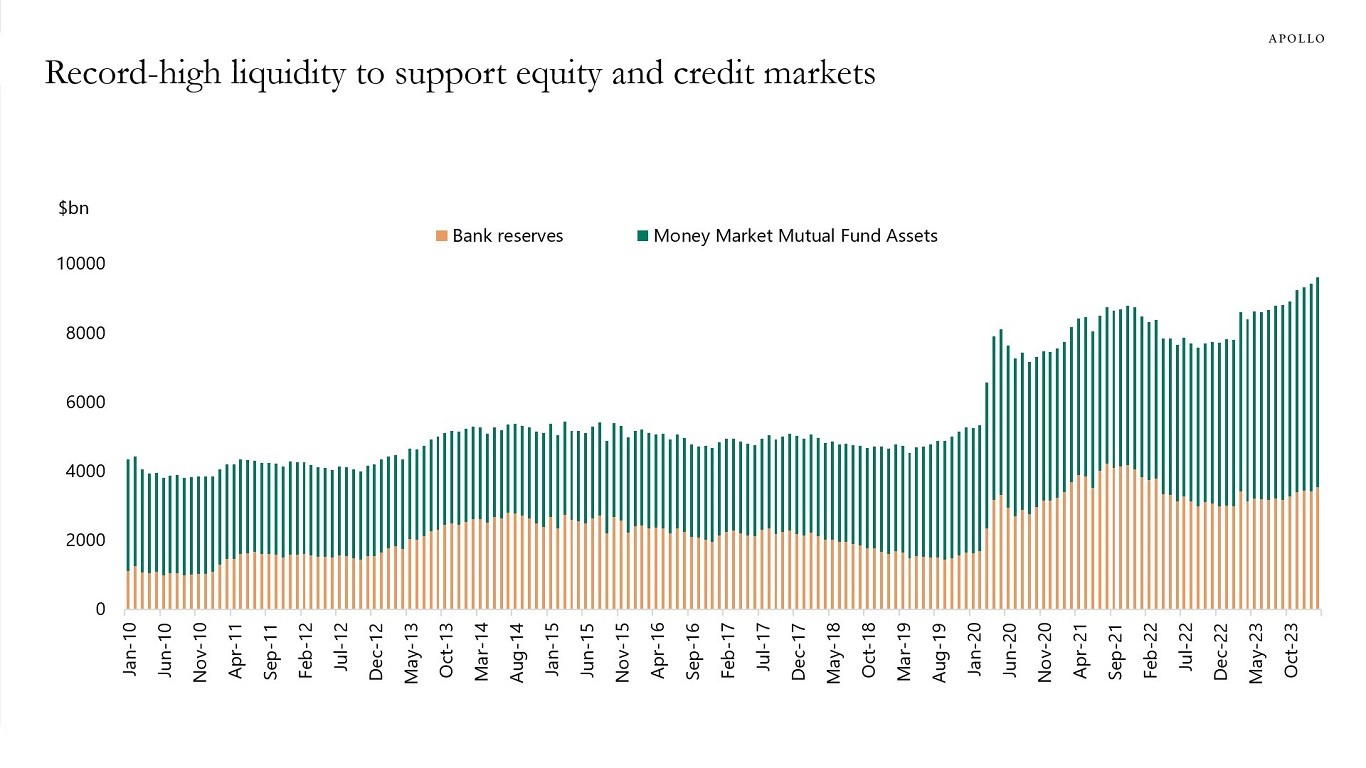

One way to measure liquidity is to add bank reserves and money market assets, see chart below which shows that there is record-high liquidity to push stock prices higher and credit spreads tighter. In particular, once the Federal Reserve starts lowering interest rates, some of the $6 trillion in money market funds is likely to find its way into stocks and bonds.

Source: ICI, FRB, Haver Analytics, Apollo Chief Economist