SFS Insights: Long Pauses Have Historically Been Good for Stocks

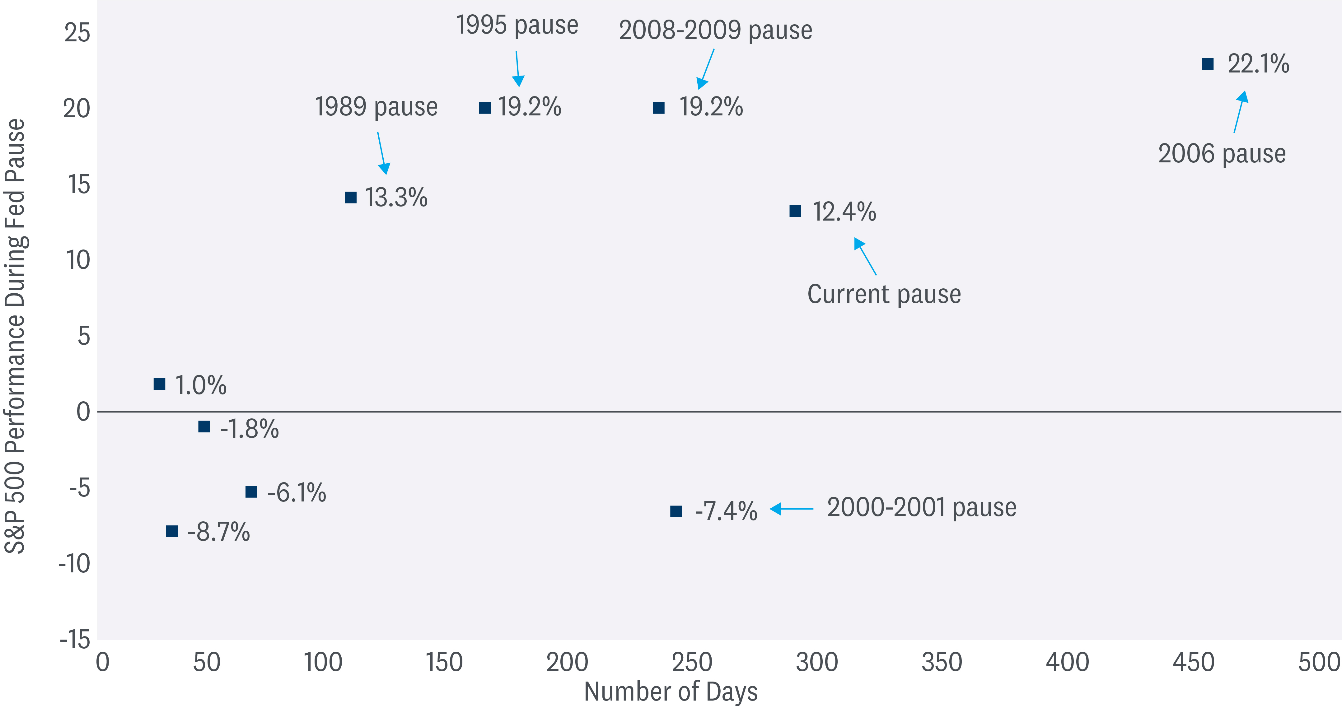

- Long Federal Reserve (Fed) pauses have historically been fairly good environments for stocks. A pause is a period where the Fed keeps rates higher and monitors the development of the economy and inflation. The Fed last raised interest rates in July 2023. The current pause has reached 280 days — the second-longest in modern market history, trailing only the 2006–07 pause that reached 446 days.

- Over the past 50 years, the S&P 500 has only gained 6% on average during pauses. But over the last six pauses going back to 1989, which have generally been longer, the average gain has been 13.1%. Long pauses are typically good for stocks.

- Long pauses have historically been pretty good environments for stocks, and we’re in one right now, even if it ends this summer (which is far from assured). It’s important to remember, however, that monetary policy is only one factor influencing markets. There are other key fundamental drivers such as the economy, earnings, and, in the long term, valuations.

Source: LPL Research, Strategas, Bloomberg, 05/02/24

Disclosures: Indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.