SFS Insights: Flashback to 1995 Federal Reserve's Rate Hike

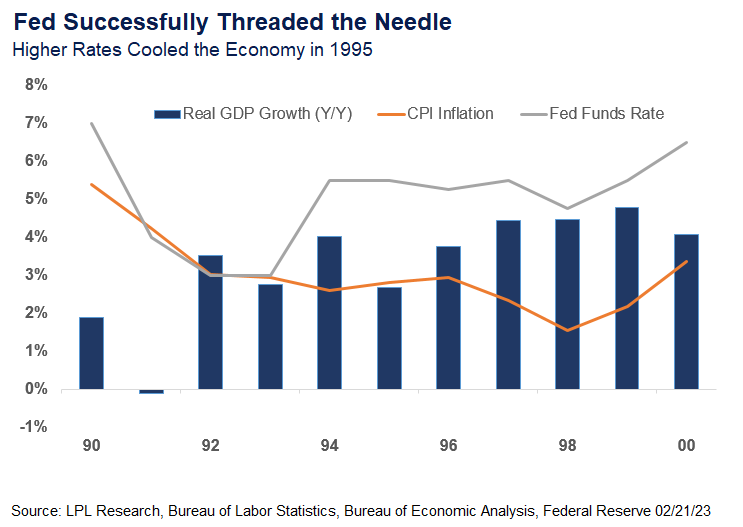

- During the hot summer of the mid-1990s, the Honorable Alan Greenspan spoke to the Economic Club of New York, where he was introduced as “the pilot we are all counting on for that very smooth and we hope very soft landing.” The economy had started overheating in 1994, so the former chairman of the Federal Reserve (Fed) raised rates, cooled the overheated economy, and the country escaped a second recession that decade.

- A soft landing is when economic growth slows but remains positive as the economy sets up for a long-term sustainable growth path. In contrast, a hard landing means the country falls into recession to break the overheated economic machine. One assumption behind the analogy is an overheated economy is not on a sustainable growth path so policy makers ought to tighten financial conditions to improve the chances the economy can maintain a stable growth rate.

- The Fed wants to tighten financial conditions so the economy can smoothly transition from the post-pandemic reopening phase, when the economy grew 5.9% in 2021 and 2.1% in 2022, to a more sustainable rate that neither stokes inflation nor stalls economic growth.

- If the economy can break the back of inflation without a deep and prolonged recession, investors will likely experience markets that could return to lower volatility and improved conditions for both bond and equity investors. We think this could be a likely outcome, notwithstanding unforeseen global shocks.