SFS Insights: First Line of Defense

BANKING SYSTEM

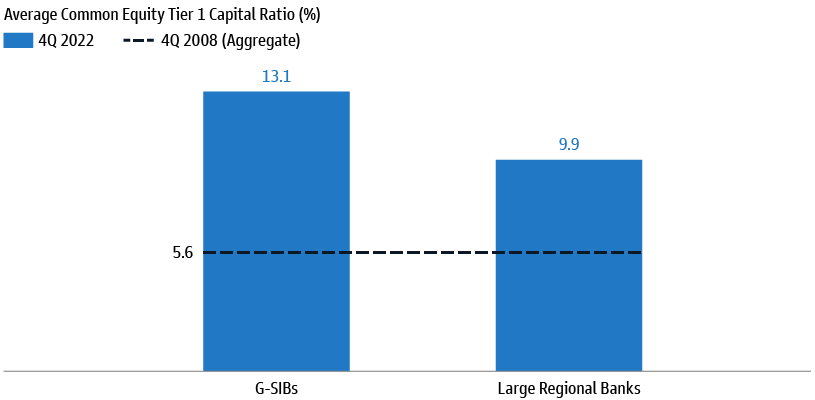

Recent stress in the financial sector has raised concerns regarding the monetary health of banks. Relative to the Global Financial Crisis, many banks today hold more cash, fewer risky real estate loans, and have lower loan to deposit ratios. In addition, Tier 1 capital ratios, representing the first line of capital available to absorb losses, are at multidecade highs, providing capital buffers for these banks.

G-SIBs: Global Systemically Important Banks

Source: Federal Reserve, GS Investment Strategy Group, and GS Asset Management.