SFS Insights: Federal Reserve Cuts Rates

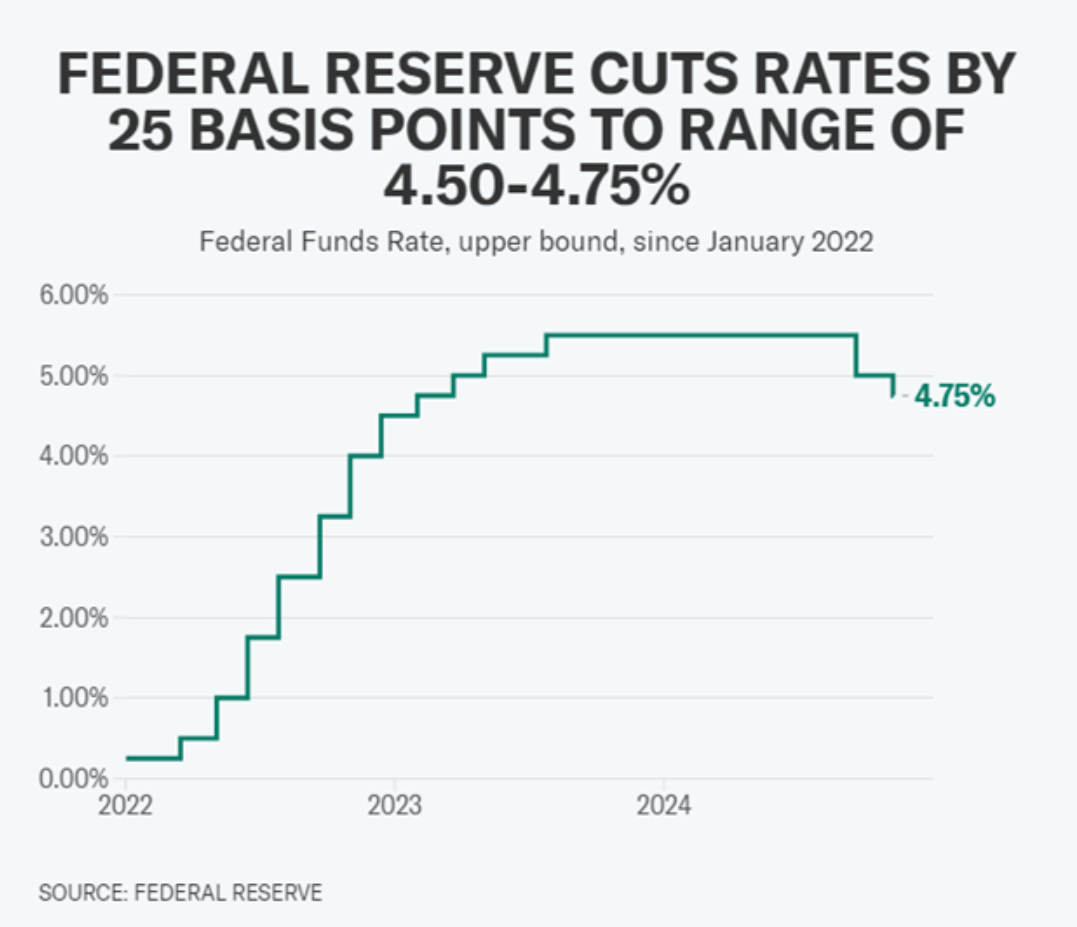

- The Federal Reserve voted unanimously yesterday to cut its benchmark rate by 25 basis points to a new range of 4.5%-4.75%, making the decision at the conclusion of its two-day policy meeting in Washington, D.C.

- Speaking at a press conference in Washington, D.C. yesterday, Fed Chair Jerome Powell voiced optimism about the prospects for achieving a "soft landing," in which the U.S. averts a recession while inflation returns to normal. "We continue to be confident that with an appropriate recalibration of our policy stance, strength in the economy and labor market can be maintained with inflation moving sustainably down to 2%," Powell said.

- The Fed is trying to strike a balance between interest rates that are high enough to keep inflation in check but not so high as to weaken the job market.

- Government data released last week showed robust economic growth over a recent three-month period, alongside a continued cooldown of inflation.

- U.S. hiring slowed in October, but fallout from hurricanes and labor strikes likely caused an undercount of the nation's workers, U.S. Bureau of Labor Statistics data last week showed.

- The remaining Fed meeting planned for this year is Dec. 17 through 18.