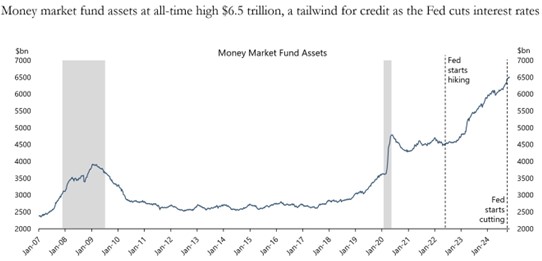

SFS Insights: Fed Hikes Added $2 Trillion to Money Market Accounts

When the Fed was raising interest rates from March 2022 to September 2024, the amount of money in money market accounts increased $2 trillion as investors liked the higher level of yields, see chart below.

What will happen with the money in money market accounts now that the Fed has started cutting interest rates? Where will the $2 trillion added to money market accounts go now that the Fed is cutting?

The most likely scenario is that money will leave money market accounts and flow into higher-yielding assets such as the bond market.

Source: Bloomberg, Apollo Chief Economist