SFS Insights: Crisis of Confidence; Not a Crisis of Data

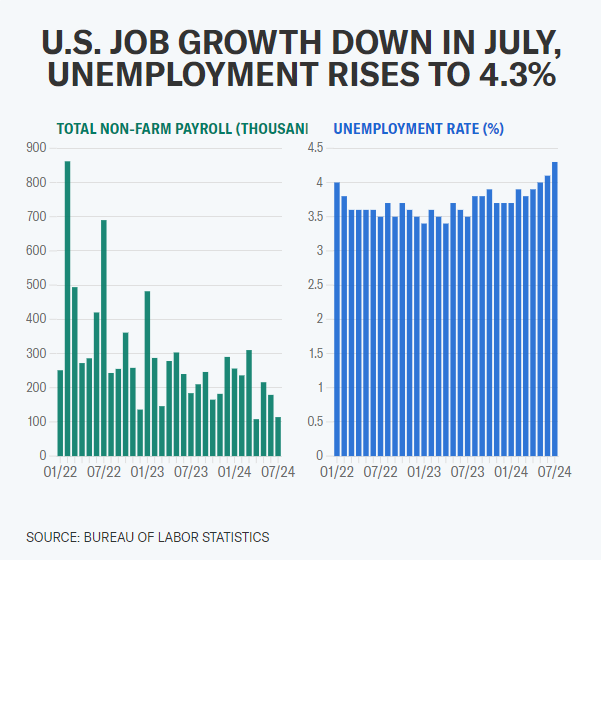

- July, the eighth positive month in the past nine, was quickly forgotten as the beginning of August greeted us with a selloff. The primary catalyst was August 2’s weaker-than-expected employment report.

- Several additional factors exacerbated the selling pressure:

- Overly bullish sentiment and elevated valuations. Investor sentiment had become a bit frothy, particularly in the tech sector, and stocks had simply gotten a bit ahead of themselves.

- Seasonality. The historically weak month of August is a logical time for a selloff to reset investor sentiment to more normal levels.

- Leverage in the financial system. Borrowing in the yen (the so-called carry trade) is unwinding as global markets fall and the yen surges — plus some institutional traders appear to have been caught offsides in the downdraft, driving more forced selling.

- Turning to potential catalysts for a rebound, perhaps the most obvious one is the Federal Reserve (Fed). A 0.5% rate cut in September is now firmly on the table, and an emergency, intra-meeting cut, though unlikely, is possible if the economy weakens further. Simply put, restrictive monetary policy is no longer necessary.

- Other drivers that could help turn stocks around include better economic data, reassuring commentary from corporate America, and more progress unwinding leveraged trades. Fundamentals still look good enough to keep this bull market going even as the economy slows into the election. Additional downside may be modest, and opportunities may soon emerge, but bottoming is a process. Be patient and allocate wisely.