SFS Insights: Commitment to Inflation Targets

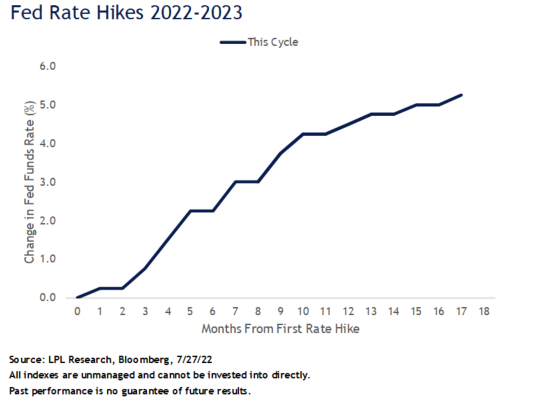

- On Wednesday, the Federal Reserve (Fed) raised its benchmark interest rate by a quarter percentage point- 5.25% to 5.50%, the highest rate in 22 years, due to ongoing concerns over high inflation.

- Fed Chairman Jerome Powell reaffirmed the 2% inflation target but acknowledged a long way to go, indicating the importance of bringing inflation down to a manageable level.

- Future rate decisions will be data-driven, and the Fed will closely monitor two jobs reports and two consumer price reports before the next meeting in September.

- The central bank aims for a “soft landing” to combat inflation without causing significant economic losses, balancing inflationary pressures, and promoting economic growth.

- The Fed’s language at the news conference suggested rate hikes could occur in September, depending on economic conditions. Powell added that the Committee would continue to evaluate new information and its implications for monetary policy, leaving their options open as they search for a stopping point in the current tightening cycle.