SFS Insights: Can A Recession Be Avoided?

- The Federal Reserve (Fed) didn’t raise rates on June 14th, leaving the Federal Funds rate in the 5-5.25% range. This was the first meeting in which they held back ever since they started raising rates back in March 2022.

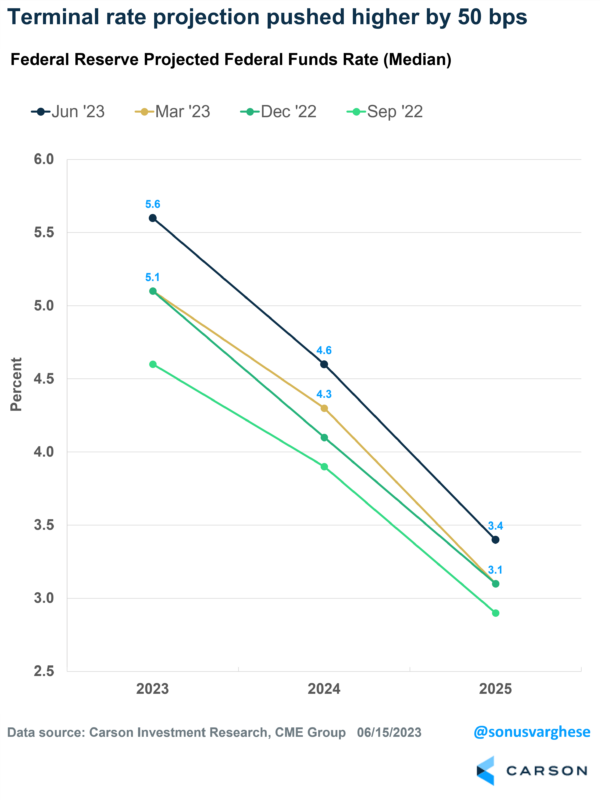

- Fed members project rates to be 0.5%-points higher than what they projected back in March. Members updated their projections for rates to hit 5.6% at the end of 2023, up from the previous estimate of 5.1%

- Along with interest rate projections, Fed members also updated their economic projections. The updated projections included: Raising 2023 real GDP* growth from 0.4% to 1% & dropping the 2023 unemployment rate from 4.5% to 4.1%. Despite projecting more rate hikes, they seem to believe that economic growth will be stronger than they expected back in March, and the unemployment rate lower.

- This is a sign that Fed officials believe that inflation can slow down without a recession.

*GDP: Gross Domestic Product- total market value of the goods and services produced by a country's economy.