Our May 2023 Newsletter: What Is The Average Retirement Savings Balance by Age?

Submitted by Saratoga Financial Services on May 8th, 2023

What Is The Average Retirement Savings Balance by Age

When reviewing your account balances, do you ever wonder where you rank among what is considered the “average” account balance for your age range?

For many, their retirement savings account is their biggest asset. Some finding even larger than the value of their home. Besides your age, there are other factors that can influence your retirement savings, such as your income, how long you have worked for your company, as well as your lifestyle choices.

Average Retirement Savings Balance by Age

Perhaps the most official measure of American retirement savings comes from the Federal Reserve System. The Fed calculated average retirement account balances for individuals in 2019, the latest year for which figures are available. Broken down by age, those balances are as follows:

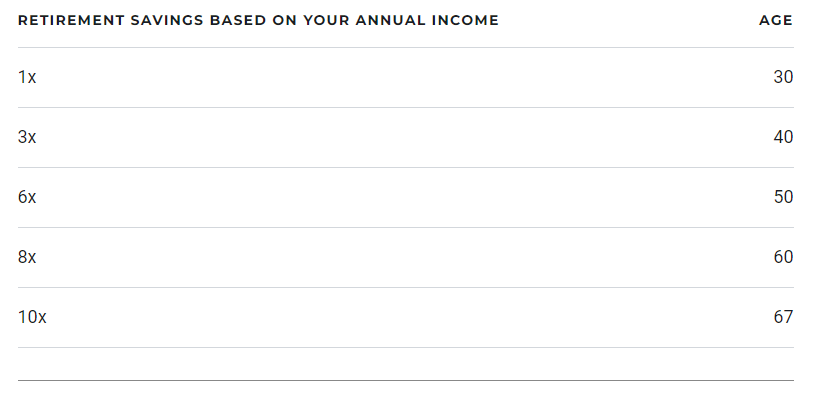

A common rule of thumb to help guide those who are saving for retirement is to look at your age versus your retirement savings based on your annual income. According to the Bureau of Labor Statistics, the average American's annual wages across all occupations as of May 2022 was $61,900. That means the average retirement account at age 67 should be $619,000.

(Source: money.usnews.com)

We hope you find these figures helpful. If you have any questions, please contact the office at (518) 584-2555.

FDIC Deposit Insurance

In light of recent banking news and questions we have received, we would like to share some helpful information regarding FDIC, Federal Deposit Insurance Corporation, deposit insurance.

Since 1933, the FDIC seal has represented a symbol of safety and security in our nation’s financial institutions. FDIC deposit insurance enables consumers to confidentially place their money at the thousands of FDIC- insured banks across the US.

The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category.

Depositors do not need to apply for FDIC insurance, coverage is automatic whenever a deposit account is opened at an FDIC- insured bank or financial institution.

- Deposits held in different ownership categories are separately insured, up to at least $250,000, even if held at the same bank.

- All single accounts owned by the same person at the same bank are added together and insured up to $250,000.

- Each co-owner's shares of every joint account at the same insured bank are added together and insured up to $250,000.

- All retirement accounts listed above owned by the same person at the same bank are added together and insured up to $250,000.

- All deposits owned by a corporation, partnership, or unincorporated association at the same bank are added together and insured up to $250,000, separately from the personal accounts of the owners or members.

- For Revocable Trust accounts, deposits are insured for $250,000 per owner per unique beneficiary. For example, a revocable trust account (including living trusts and informal revocable trusts commonly referred to as payable on death (POD) accounts) with one owner naming three unique beneficiaries can be insured up to $750,000.

- The FDIC did approve a final rule to amend the deposit insurance regulations for trust accounts that will take effect on April 1st 2024 that will limit beneficiaries up to a maximum of five beneficiaries.

You can get detailed information about your specific deposit insurance coverage by accessing the FDIC's Electronic Deposit Insurance Estimator and entering information about your accounts. Click here to access the FDIC's Electronic Deposit Insurance Estimator.

(Source: FDIC.gov)

Did You Know?

401(K) Facts

- The modern 401(k) originated in earnest in 1978 with a provision in The Revenue Act of 1978 which said that employees can choose to receive a portion of income as deferred compensation, and created tax structures around it.(Source: guideline.com)

- Ted Benna, is popularly known as the “Father of the 401(k)” for his work advocating for companies to adopt plans in accordance with the IRS’ new Revenue Act of 1978. (Source: the guideline.com)

- Nearly half of all large employers in the U.S. were offering 401(k) plans to their workers by the end of 1982. (Source: guideline.com)

- The Small Business Job Protection Act came along in 1996 and simplified retirement programs—called SIMPLE plans—for small businesses. The Act signed into law was intended to help make America’s small businesses more competitive with large firms. (Source: guideline.com)

- The average age of retirement for Americans is 66, according to a Gallup poll, which is up from age 60 in the 1990s.

See You Tomorrow!

Come safely dispose of your old documents and confidential files at our Shred Event, tomorrow, May 6th 2023!

We will be at the JC Penny parking lot at the Wilton Mall from 9am to 11am.

A special thank you to our local partners: Act With Respect Always & Confidata.

As well as our local sponsors: Saratoga County Chamber of Commerce, The Saratoga Business Journal & The Wilton Mall.

We hope to see you there!