SFS Insights: Inflation Continues Cooling Down In The U.S

Latest Inflation Report Fueling Bets the Federal Reserve (Fed) is Almost Done

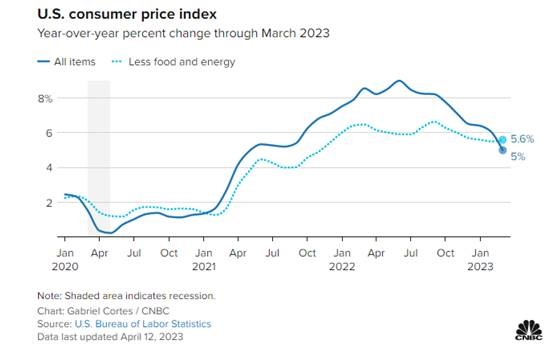

- Consumer prices rose at the slowest pace since May 2021 as inflation showed further signs of easing in March, according to the latest data from the Bureau of Labor Statistics released Wednesday morning.

- The Consumer Price Index (CPI) revealed headline inflation rose 0.1% over last month and 5.0% over the prior year in March, a slowdown from February's 0.4% month-over-month increases and 6% annual gain.

- Both measures were slightly better than economist forecasts of a 0.2% month-over-month increase and 5.1% annual increase, according to data from Bloomberg.

- Food at home fell in March, the first monthly decline in prices since mid-2020, finally easing some pressure off household budgets.

- Excluding shelter costs, consumer prices rose 3.4% from a year ago, fueling bets that the Fed is close to ending its rate hiking campaign. As the economy slows, consumer prices will decelerate further and should bring inflation closer to the Fed’s long-run target of 2%. Forecasts are gaining more confidence that the next Fed meeting may be the last meeting where the Committee raises the fed funds target rate.